As an established global healthtech company, RxMx saw an opportunity to capture a larger share of digital patient monitoring programs through further investment in sales and technology, as well as to diversify revenues and accelerate growth through a targeted buy and build program. The owners saw Pemba as a logical partner due to their proven track record of supporting high growth technology businesses through both organic and acquisitive growth strategies.

The Deal

Pemba Capital Partners – a leading investor in high growth technology businesses with a focus on buy and build partnerships, has invested in RxMx, a pharma software provider of proprietary digital risk management and patient adherence SaaS solutions in the specialty medicine sector.

About RxMx

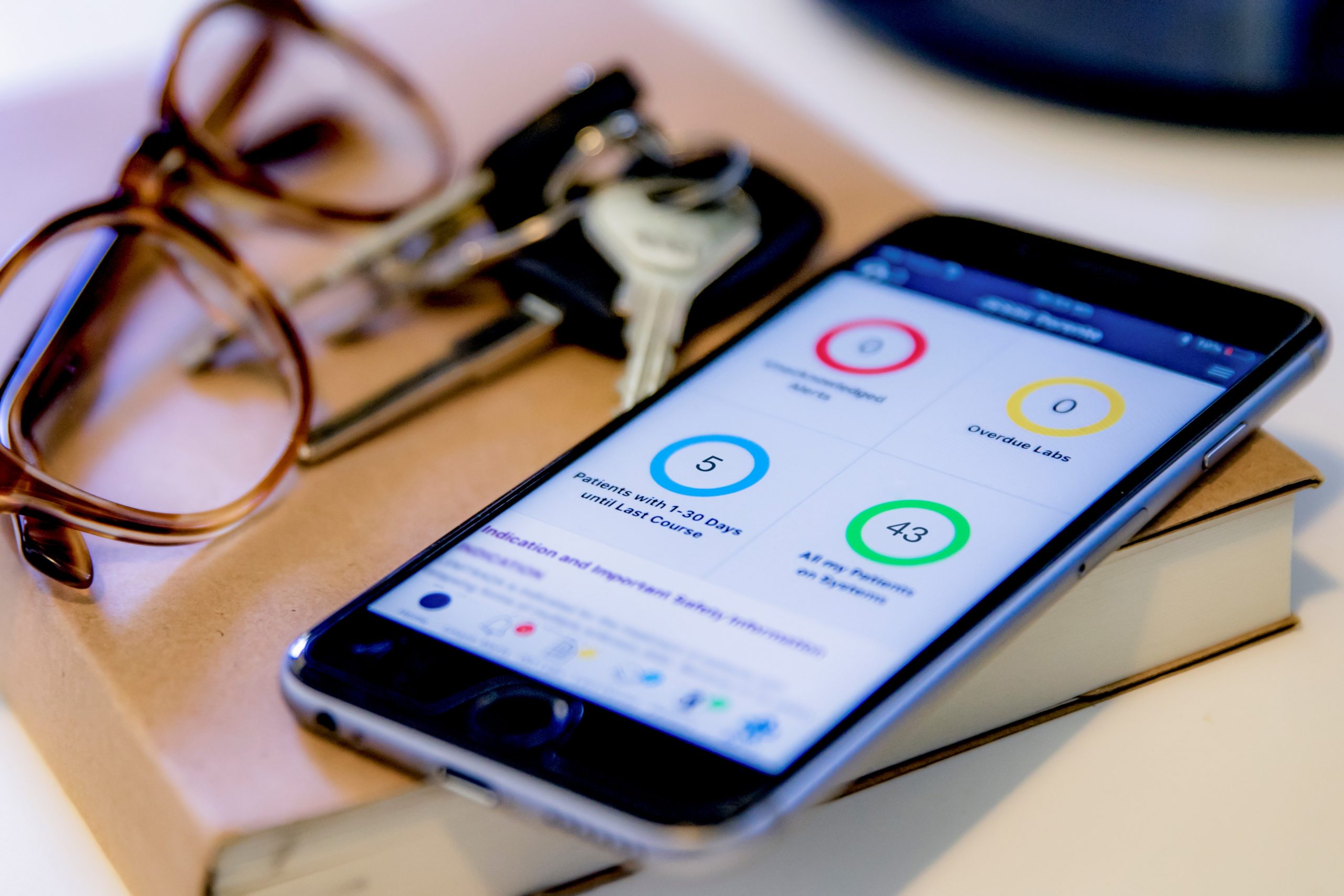

Established in 2013, RxMx is based in Sydney and has offices in New York and Berlin. Founded by doctors who wanted to modernise the process of prescribing and monitoring specialty medicines, RxMx provides digital risk management and patient adherence SaaS solutions in the specialty medicine sector, predominately in the Multiple Sclerosis (MS) market. It is focused on the commercialisation stage of the drug life cycle, assisting pharmaceutical companies on the launch and global roll out of new and in-market approved drugs. The company assists physicians, patients and some of the world’s largest drug manufacturers through its technology offering Chameleon, a proprietary, highly scalable and configurable cloudbased SaaS platform.

Background to Pemba’s Investment

RxMx had grown to become a global healthtech business with a leadership position in MS through clinical expertise and digital solutions. However, the founders were looking for an experienced technology investor to support and invest in a growth plan to drive growth across new therapeutic areas that have treatment/monitoring profiles suited to the RxMx platform. In addition to supporting the organic growth plan, the founders wanted a partner that could accelerate RxMx’s development through a carefully targeted ‘buy and build’ program to create a technology-led niche hub services player for large global pharma companies. RxMx ran a limited process to test the market but quickly chose to partner with Pemba due to Pemba’s technology and healthcare expertise, buy and build growth strategy and alignment with regards to their patient-centric approach.

The Vendor’s Perspective

The Future

With Pemba’s backing, RxMx will further expand its global services around the world, continue to invest in building out its technology and scale operations to capture a larger share of digital patient monitoring, familiarisation and adherence programs.

Click to download PDF

Pemba & Technology

Pemba is a leading investor in the Australian and New Zealand technology sector, with investments in Placard (the regional leader transaction card payments technology), HR3 (a payroll and HR software provider) and now JobReady. Pemba’s team is looking to invest in further high-quality technology providers. If you are considering outside investment and would like to find out more about how Pemba partners with its investee companies to achieve significant growth, please call email opportunities@pemba.com.au