Tom Matthews

Ask any tech investor about their ultimate investing goal and the term unicorn is likely to come up. In fact, many tech investors scour the market in pursuit of the next tech “unicorn”.

However, at Pemba, we take a very different approach.

What is a unicorn?

The term unicorn refers to a private company with a value of over $1 billion. The term was first published in 2013, coined by venture capitalist Aileen Lee, choosing the mythical animal to represent the statistical rarity of such successful ventures.

At the time, only 39 companies were identified as unicorns. Today’s unicorns are no longer as rare as their mythical counterparts. In fact, CB Insights identified 1,170 unicorns worldwide as of June 2022.

Why invest in unicorns?

Investing in tech unicorns can be extremely exciting. Many of these companies have scaled really quickly by “Blitzscaling”. Blitzscaling involves deliberate and significant cash burn to rapidly build out a company to serve a large and usually global market, with the goal of becoming the first mover at scale.

If you’re an investor with a higher risk tolerance than most, investing in a unicorn company could be the right move for you. While there’s great risk involved, there may also be a great reward if you can get in on the ground floor of an investment that will shake a certain sector or industry.

Has the tide gone out?

However, for all the promise of participating in the creation of private billion-dollar companies, many unicorn investors could soon be looking at disappointing returns. Changing market conditions might signal the end of an era of inflated valuations.

Rising inflation and surging interest rates have seen markets decline, with many of the biggest losers being the mega-cap tech firms. Even at the smaller end of town, tech companies are facing a very different environment, where fresh capital is suddenly much harder to find and growth for growth’s sake isn’t being rewarded.

A shift to profits over prophets

In the current macro-environment, investors are rewarding companies with attractive profit margin profiles or companies who can demonstrate a pathway to profitability over those with high cash burn rates chasing growth for growth’s sake.

Many tech company founders are now having to make tough decisions about cost cutting, conserving cash and proving the sustainability of the unit economics.

The Pemba approach

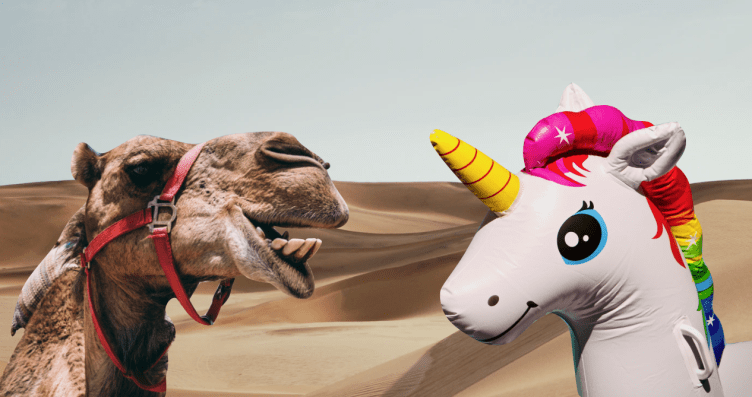

At Pemba, we take a very different approach to tech investing. Instead of the unicorn, the camel is the more fitting mascot for what we look for.

Camels are able to survive for long periods without sustenance, withstand the scorching desert heat, and adapt to extreme variations in climate. They survive and thrive in some of the planet’s harshest regions.

At Pemba, we look for tech companies that provide mission-critical solutions to their clients, within defensive growth markets. Often these companies were established many years ago and have survived (and often thrived) through multiple economic cycles.

Bootstrapping over Blitzscaling

At Pemba, we typically back founder-owned tech businesses that have been bootstrapped to the point of our investment. These companies are profitable and usually cash generative.

We find that founders of bootstrapped companies have a very different mindset than those deliberating burning cash to grow quickly. That philosophy of ensuring there is a return for every dollar invested in the business is important to us.

What’s fascinating is even when a founder sells a majority of their business to Pemba, that focus on cost control remains strong – the founder still views every dollar as their own. In fact, it can be extremely difficult trying to convince the founder to make investments that will ultimately accelerate the growth of the business.

Moving from survive to thrive

Prior to partnering with Pemba, survival is often the primary strategy of the founders of camels. We utilise our access to capital, strategic support and networks to enable the founder to make bigger and bolder moves and transition their mindset from “playing not to lose” to “playing to win”.

A 20 year overnight success

Founders of camels understand that building a company is not a short-term endeavour. For many, breakthroughs don’t come immediately, but rather occur later in the company timeline.

We’ve helped founders of our tech camels accelerate the growth of their organisations and achieve some incredible business outcomes like ASX listings, international expansion, transformational acquisitions, etc. It’s often only after these outcomes have been achieved that the founder and company finally get the recognition they deserve.

Final remarks

If you’re interested in reading more about investing in camels, then I recommend this HBR article. Alternatively, email me at tomm@pemba.com.au and I’d be happy to discuss further.